Lets Talk About Debt

- Matt Cochrane

- Jul 18, 2024

- 6 min read

Let’s Talk about Debt: Navigating the Double-Edged Sword

Welcome back! Last week, we delved into why and how to craft an emergency fund to cushion you against life's financial uncertainties. This week, we turn the spotlight onto a subject that many people often misunderstand or even fear—debt. But let's clear the air: Debt isn't inherently evil; it's a financial tool. Much like a hammer can be used to build up something or to break down something, debt can either help construct your financial future or shatter it. The key lies in knowing how to wield it wisely.

To lay the groundwork for a future discussion, let's touch briefly on Ray Dalio's, a world renowned financial commentor and investor, simple explanation of debt in his renowned animated YouTube video. In this video, Dalio likens debt to either the fuel in an engine powering you forward or the fuel in a Molotov cocktail ready to damage future plans, depending on how it's managed. Dalio also offers the perspective that taking on debt is like "pulling future spending into the present." This means that when you take on debt, you're essentially borrowing from your future self. So, the key question is: will your future self thank you or resent you for the debts you take on today?

The Good: The Art of Leveraging Debt

So, what's to like about debt? In the finance world, we often refer to debt as "leverage." The idea is straightforward: you borrow money at a certain interest rate and invest it in something that you expect will yield a higher rate of return. It's like using a lever to lift a heavier weight than you could with your bare hands. A classic example here is a mortgage. When you take out a loan to buy a property, you're making a bet that the home's value will increase over time. And if it does? You've successfully leveraged debt to your advantage. The same goes for student loans—think of them as an investment in your future earning potential.

The Bad: The Downward Spiral of Debt

However, it's crucial to remember that not all debt is created equal. There's a darker side to debt that can be financially devastating if you're not careful. High-interest debts like credit card balances, payday loans, and store credit cards are notorious for their snowballing interest rates. Every holiday season, the advertisements promising easy credit at alarming APRs are enough to make any financially savvy person cringe. These are the debts that can quickly lead you into a never-ending spiral, where you find yourself borrowing more and more just to pay off what you already owe, digging yourself deeper into financial trouble.

Firstly, Gain visibility.

We've touched on the good and the bad of debt, but let's be real: at some point, most of us will need to manage existing debts. And how you manage them could mean the difference between financial freedom and a financial fiasco. Here's how you can do it:

Know Your Debt: The first step is awareness. List down all your debts, be it mortgage, student loan, or credit card balances. Note down the interest rates for each. This will give you a clear picture of your debt landscape.

Prioritize: Tackle the high-interest debts first. This is what's known as the 'avalanche method,' aimed at minimizing the amount you'll pay in interest over time. The sooner you eliminate these, the less they'll cost you.

Budget for Payments: Your budget isn't complete without a line item for debt repayment. Make it a non-negotiable expense, much like rent or utilities. Missing a payment is a quick way to hurt your credit score.

Negotiate: If you're in a tight spot, call your creditors and negotiate the terms. You'd be surprised at how much flexibility some are willing to offer when you communicate.

Seek Professional Help: If your debt is spiraling out of control, don't hesitate to get professional guidance. Whether it's a financial advisor or a debt management service, there is help available. Some charities even offer impartial advice on this topic, so you can trust that the guidance is in your best interest.

Act Now: You've armed yourself with the knowledge to better understand and manage your debt. Now it's time to put that knowledge into practice. Take the next 30 minutes to list out all your debts and their respective interest rates. Then, add a line item in your budget for debt repayment.

Secondly, Manage Your Debt

Different debt-tackling strategies work for different people, depending on their mindset and finances. Two of the most popular methods are Dave Ramsey's "Debt Snowball Method" and the "Debt Avalanche Method."

Debt Snowball Method

The essence of this strategy is rooted in psychology and the power of small wins. To employ this method, list all your debts from the smallest to the largest amount. Ignore the interest rates for now; just focus on the size of the debt. The plan is to aggressively pay off the smallest debt while making minimum payments on the rest. Once you wipe out the smallest debt, you roll that payment into the next smallest, creating a "snowball" effect. The aim here is to build momentum and provide psychological boosts by eliminating debts one at a time, thereby empowering you to tackle larger debts with increased enthusiasm.

Debt Avalanche Method

On the other hand, the Debt Avalanche Method focuses on the financial mechanics of debt. Unlike the Snowball Method, the Avalanche approach prioritizes your debts based on the interest rate, from highest to lowest, rather than the amount owed. The logic is simple but compelling: by focusing on the debts with the highest interest rates, you minimize the total amount you'll pay over time. So, you aggressively pay off the highest interest debt while maintaining minimum payments on others. Once that's done, move to the debt with the next highest interest rate.

Critics of the Snowball Method argue that it might not always be the most financially efficient, especially if your smaller debts also have lower interest rates. However, the psychological benefits of achieving quick wins can be invaluable, making it easier for you to stick with your debt repayment plan. Conversely, the Avalanche Method may require more discipline, as the financial rewards are more gradual and less immediately apparent.

Ultimately, the choice between the Debt Snowball and Debt Avalanche Methods will depend on what motivates you to stick with a plan. Some people thrive on quick wins, while others are more motivated by the thought of saving money in the long run. Choose the method that aligns best with your needs and financial goals.

Act Now: Ready to manage your debt effectively? Choose between the Debt Snowball or Debt Avalanche method today. Commit to one and make your first targeted payment this week.

The Liberating Power of Cleared Debt

The world of debt is indeed a double-edged sword. On one side, it can be a potent tool for leveraging growth and opportunities; on the flip side, it can be a crippling burden if not carefully managed. Taking steps to gain control over your debt not only unshackles you from financial stress but also opens doors to other financial possibilities. Just imagine a life where your income is no longer funneled into paying off debts but is free to be invested in opportunities that can genuinely better your life and create wealth over time. That's the power of debt management.

Both the Debt Snowball and Debt Avalanche Methods come with their own pros & cons. Your personal circumstances and what motivates you will ultimately determine the best approach for you. There is no one-size-fits-all answer, so take time to understand your financial situation. Commit to a plan that suits you, and you'll find that as each debt clears, you gain not just financial relief but also a sense of accomplishment and freedom.

A Final Word and A Teaser for Next Week

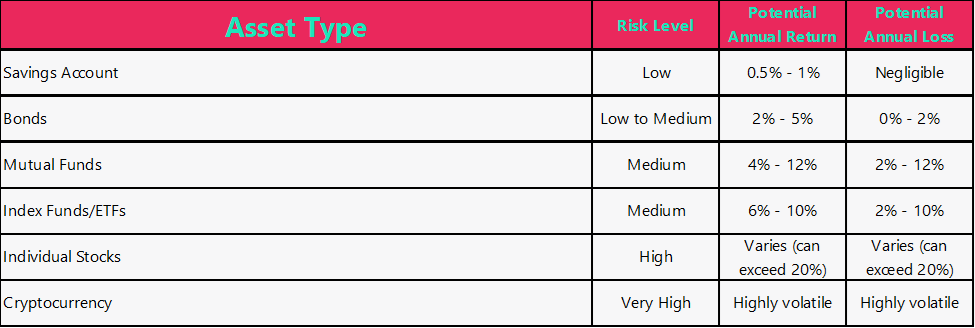

Remember, debt is neither inherently good nor bad; its impact depends on how you manage it. The choice is entirely yours. Use your newfound understanding of debt management as a stepping stone to better opportunities. So, what comes next after freeing yourself from the shackles of debt? It might be tempting to revisit old spending habits or acquire new debts to celebrate your freedom, come on we have all done it? But resist those impulses. Instead, consider redirecting those previously allocated monthly payments into something more productive—like learning how to invest.

Investing is the natural progression once you've effectively managed your debt and It's also the subject of our blog post for next week. We'll explore the art and science of making your money work for you so that you're not just saving but actively growing your wealth. Stay tuned!

And that’s a wrap for this week! If you have any questions or thoughts, don't hesitate to reach out through our website or social media channels. If you found this blog helpful, please share it with others who might benefit as well. Here's to your financial well-being and future prosperity!

Enjoy your newfound financial clarity.

Matt, The Compound Coach

Comments