Let's Talk About Investing

- Matt Cochrane

- Jul 18, 2024

- 7 min read

Let's Talk About Investing: The Silent Engine of Wealth

Hello, everyone! Welcome back to our ongoing "Let's Talk About" series. Over the past few posts, we've been building blocks of financial knowledge, ensuring a rock-solid foundation before venturing into more complex terrain. From delving into the psychology of money to demystifying the essentials of budgeting, and most recently, emphasizing the critical role of savings and emergency funds, we've covered a lot of ground. Today, we're placing one of the final cornerstones to our foundational knowledge, the art of investing, looking at how to make your money work harder for you.

Generating Long-Term Wealth

Imagine you've built your dream home, and now you're thinking about energy efficiency and long-term sustainability. That's where solar panels come in. They may require an initial investment and a bit of strategic planning, but once they're installed, they generate electricity for you, reducing your energy bills, and sometimes even earning you money by selling surplus energy back to the grid.

In the world of finance, these solar panels represent your investments. Just like solar panels, quality investments require an upfront commitment but can generate an ongoing return. They add value to your financial house, provide a sense of long-term security, and can create a surplus in the form of dividends, interest, or capital gains, further empowering your financial freedom.

Why Invest: Take back control of your time

It's an age-old question: Why should we invest? The answer is multifold but let's start with a piece of timeless wisdom from Warren Buffett, "If you don't find a way to make money while you sleep, you will work until you die." If there's one thing we can't manufacture more of, it's time. While you can't create more hours in the day, you can optimize how those hours are spent. This is where investing enters the scene, acting as your personal time liberator. Just like solar panels can free you from dependency on the energy grid, a well-planned investment strategy can free you from the 9-to-5 grind far earlier than you ever thought possible. Here's a sobering thought, the retirement age keeps creeping up, and there's talk of it stretching well into the 70s. Sure, working until you're 70 or beyond is a choice, but wouldn't you rather have the option to retire earlier? A smart investment strategy can give you that choice. It provides a pathway to financial independence, where the income generated from your investments can sustain your lifestyle without requiring you to clock in for a day job.

Empowerment Starts Now

Investing is not just about stashing money away for a distant future. It’s about growing your wealth so you can make impactful decisions in the here and now. Want to switch careers? Go back to school? Take time off to care for a loved one? Your investment portfolio can give you the financial cushion to make these choices without economic hardship.

By learning the art of investing, you're not just saving money, you're actively growing it, creating additional income streams, and building a safety net for whatever life throws your way. So why invest? Because your financial well-being and freedom are too important to leave to chance. The power of investing lies not just in the end goal, but also in the journey it facilitates. It's about not waiting until your golden years to start living your life fully. It's about achieving milestones at your pace, whether that's retiring at 50, taking a mid-career break, or funding your child's education without loans. In other words, investing serves as the solar panels on your financial house roof, constantly generating "energy" to power the life you desire. So, you're sold on the idea of investing, but where do you begin? The financial markets can seem like an overwhelming maze of options but fear not. Getting started is much simpler than you might think.

Understanding Risk, Reward and Diversification

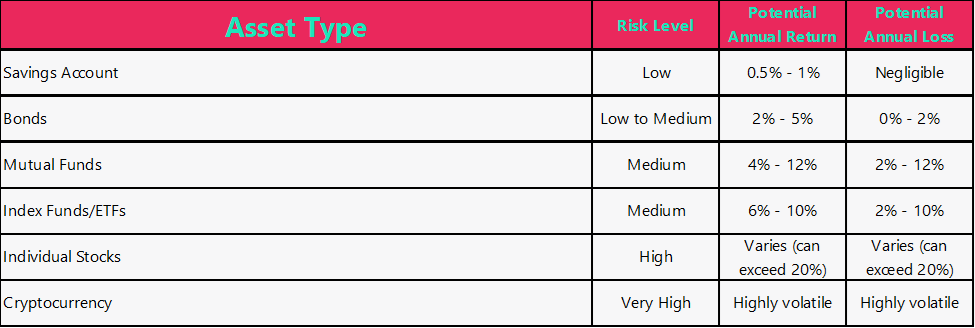

Investing isn't just about the potential for high returns; it's also about understanding and managing risk. All investments come with some level of risk, but generally, higher risk comes with the potential for higher rewards—and, of course, higher losses. Below is an example outlining different types of investments, their associated risk levels, and their potential annual returns and losses.

Savings Account

For those who cannot afford to lose any principal, a savings account is the safest option. However, the growth potential is very limited—barely keeping up with inflation in most cases. Consider a traditional savings account at your local bank offering an annual interest rate of 0.5%. If you deposit $1,000, you will earn $5 in interest over a year.

Bonds

Bonds are generally stable and offer a higher return than a savings account. They are a good choice for conservative investors seeking steady income. U.S. Treasury Bonds are a good example. A 10-year Treasury bond might offer an annual yield of 2%. If you invest $1,000 in such a bond, you'll earn $20 in interest each year.

Index Funds/ETFs

Index Funds and ETFs offer a moderate level of risk while providing broad market exposure. These funds are ideal for investors looking for a balanced approach, mixing some level of risk with the potential for reasonable returns. The Vanguard S&P 500 ETF (VOO) aims to track the S&P 500 index, providing broad exposure to large-cap U.S. stocks. In the past decade, it has seen average annual returns of around 8%.

Mutual Funds

Mutual funds are great for those who prefer a hands-off investment approach but still seek higher returns than bonds or savings accounts. Managed by professionals, they pool money from multiple investors to buy a diversified set of assets. Invest $1,000 in a mutual fund focusing on large-cap companies. Managed by experts, this fund has a 10-year average annual return of 7%. Your $1,000 could grow to nearly $2,000 in 10 years, providing diversification and professional management without the hassle of tracking individual stocks.

Individual Stocks

Investing in individual companies like Apple can offer substantial returns but also carries higher risk compared to diversified investment vehicles like index funds. This type of investment is best suited for those who have a good understanding of the market and are willing to assume a higher level of risk. If you had invested in Apple stock in 2010 when the share price was around $30, you would have seen significant growth over the decade. As of 2020, Apple's stock price had risen to approximately $134, even accounting for stock splits. That's a multiple of over 4 times your original investment.

Cryptocurrency

For the thrill-seekers among us, cryptocurrencies like Bitcoin and Ethereum offer the potential for outlandish returns but come with a significant level of risk and volatility. In 2017, Bitcoin started the year at approximately $1,000 and peaked at around $19,000 by the end of the year. However, in 2018, it crashed to around $3,000.

Why Diversification Matters

Diversification acts as your financial barrier, minimizing the impact of poor performers while offering avenues for potential gains. By holding a mix of low, medium, and high-risk assets, you create a more resilient portfolio that aligns with your financial goals and risk tolerance.

For instance, consider bonds and index funds. While bonds offer a lower return, they provide a safety cushion. Index funds being inherently diversified as they are a basket of companies, balance out the risks and offer stable returns. On the other hand, individual stocks and cryptocurrencies can provide high returns but come with significant risk. By having a range of asset types, you not only spread your risk but also increase your potential for a well-rounded portfolio return.

The takeaway here is that understanding your risk tolerance and employing diversification are key elements in building a robust investment strategy. They enable you to tailor your investment portfolio to meet your specific financial needs and goals, while also providing a safety net to protect you during market downturns. By recognizing how risk and diversification play into your investment choices, you're well on your way to not just saving money, but actively growing it.

Choosing the Right Investment Vehicle

The world of investing is rich with choices as you have seen above, believe it or not, the instruments mentioned so far are just the basics. More complex financial instruments exist, but they are neither simple to understand nor readily accessible to the average investor. We'll save that discussion for another day. With such an array of options, aligning your investments with your financial goals, risk tolerance, and investment knowledge becomes a critical task.

"If You Can't Beat the Market, You Better Join It"

Once more, let's turn to Warren Buffett, often cited as one of the most successful investors of all time with a nickname of the "Oracle of Omaha”. Mr Buffet once made a simple but powerful wager against Wall Street hedge fund managers. Over a ten-year period, he bet that an S&P 500 index fund would outperform a portfolio curated and managed by seasoned professionals. Buffett won that bet, teaching us all a valuable lesson: often, simplicity trumps complexity when it comes to investment strategies.

If you're feeling brave enough to manage your own investments but want a relatively hands-off approach, consider automated payments into a low-cost S&P 500 ETF. Chances are, you'll be advising me to do the same in a few years, as I continue to lean towards the higher-risk categories with varied success against the market's consistent upwards trajectory.

So You're Invested—What's Next?

Less is often more when it comes to managing your investments. Lower activity usually translates to reduced expenses and less time spent pouring over your portfolio. While our previous blogs have emphasized the value of monthly snapshots for keeping tabs on your financial health, there's a case to be made for more comprehensive, annual review. We will go into this topic further in a later “Let’s talk about” conversation as the annual review can be a self-reflection that we don’t always want to make.

Coaches Comment: Unlock Your Financial Future

Investing isn't just a buzzword—it's your ticket to financial freedom and reclaiming control over your time. While the key principles may seem straightforward—understanding your risk tolerance, diversifying your portfolio, and remaining adaptable—the challenge often lies in exercising the patience and discipline to let them take effect.

Warren Buffett, who served as a reference for this post, swears by a straightforward strategy: never invest in something you don't understand or can't explain simply. These are good rules of thumb for any investor. So, what steps can you take today to move toward your investing future? Consider starting small. Could you automate a small portion of your next paycheck into a beginner-friendly mutual fund or index fund? Already engaged? Fantastic! Keep the momentum going.

Need to think about an annual review? Remember to review, reassess, and realign your portfolio regularly. Trust us, your future self will thank you. Do you have questions or success stories? We're all ears. Connect with us through our website or social media channels and share your investment journey. Your insights could be the next big teaching moment for our community.

What's Next?

Keep an eye out for next week's "Let's Talk About" installment, where, fittingly for our 8th blog post, we'll delve into the "8th wonder of the world": compounding.

So, what are you waiting for? Your financial future isn't going to build itself. Take the first step today.

Matt, The Compound Coach

Comments