Let’s Talk About Savings & Emergency Funds

- Matt Cochrane

- Jul 18, 2024

- 5 min read

Let’s Talk About Savings & Emergency Funds: Your Financial Safety Net

Hello everyone! Welcome back. If you've been following along with the "Let’s talk about" series, you're already familiar with some vital topics. From understanding the psychology of money to unlocking the essentials of budgeting, we've laid the foundational bricks and drawn the architectural plans for your financial house. Today, we're going to focus on a topic that often gets relegated to the “I’ll think about it later” category: Savings and Emergency Funds.

The House is Burning!

You might recall from our last blog that we compared your financial life to a house, with budgeting serving as your architectural plans. Well, if we continue with that analogy, think of your emergency fund as the smoke detectors and fire extinguishers installed in your home. These are not items you engage with every day, but they are essential for immediate response during emergencies. Just like a fire extinguisher can prevent fire from turning into a full-blown house blaze, an emergency fund can stop an unexpected expense from derailing your financial stability. It’s what you reach for when unplanned events such as a medical bill, car repair, or sudden job loss ignite a financial crisis, helping you keep your "financial house" intact. In the world of finance this quick access to funds / cash is called Liquidity. "Liquidity" is your ability to quickly convert assets into cash without a loss in value. An emergency fund is the embodiment of liquidity — it's money that’s readily accessible when you need it most. No stock sales, no withdrawal penalties, just straight-up cash that can be the difference between a hiccup and a financial catastrophe.

Building Your Emergency Fund: How Much is Enough?

So now that we understand the importance of an emergency fund, the next question is: How much do you need? Conventional wisdom suggests saving enough to cover at least three to six months' worth of living expenses. For some, a $1000 starter fund might be a feasible starting point; for others, especially those with families or higher financial commitments, a more substantial cushion may be necessary.

To find your ideal number, look at your monthly expenses—everything from mortgage or rent payments, utility bills, groceries, and any loan repayments. Multiply this by the number of months you want to cover, and voila! You have your emergency fund goal, its that simple

Divide and Conquer: The Savings Buckets Strategy

When it comes to saving, not all accounts are created equal. Earlier we touched upon the importance of "liquidity," and now let's delve into the 'savings buckets' strategy.

Emergency Fund Bucket: The most liquid and easily accessible, this is the fund you dip into for immediate crises. This bucket typifies liquidity.

Short-Term Savings Bucket: For foreseeable expenses within the year—holidays, insurance premiums, or a planned home repair. While still easily accessible, the goal here is to not touch this money unless it’s for the expense it was intended for.

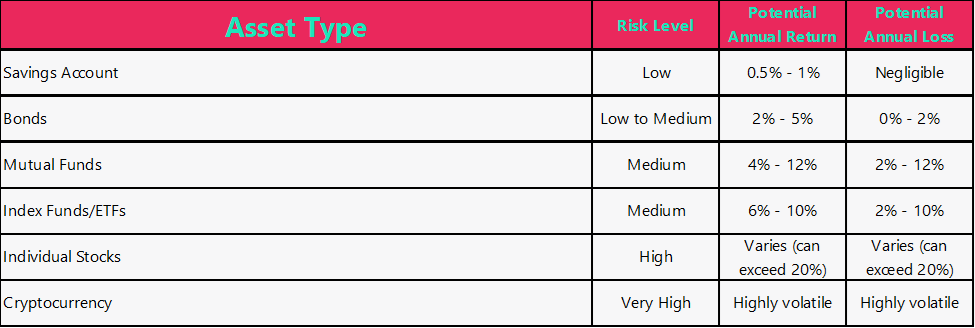

Long-Term Savings Bucket: This is your down payment for a new house, your children's education, or even early retirement. Money in this bucket can be invested in less liquid assets with higher returns, like mutual funds or bonds.

A good practice is to name these buckets specifically—like "Mexico Holiday 2025." When your savings goals have meaningful names, it might discourage you from withdrawing unnecessary funds, see below example from an upcoming The Compound Coach saving and investing planner.

Automate to Activate: The Easiest Way to Save

Remember how we sang the praises of automation in our budgeting blog? It turns out, the magic of automation isn't limited to budgeting alone. When it comes to savings, automating your deposits can be a game-changer.

Why Automation Works

Think about it: What gets prioritized often gets done. By setting up automatic transfers to your various savings buckets—the emergency fund, short-term, and long-term buckets—you prioritize saving without even having to think about it. This turns saving from a tedious manual task into a seamless part of your financial ecosystem.

Highlights of Automated Savings:

Consistency: Regular, automated contributions help you build your savings steadily over time. A consistent deposit, even if it's small, accumulates into a substantial amount thanks to the magic of compound interest.

Timeliness: By scheduling your transfers immediately after payday, you effectively make saving the first "expense" you pay each month. This is a psychological win and a practical one, ensuring you're never "too late" to save.

Reduced Temptation: When money automatically goes into designated buckets, you’re less likely to consider it 'available' for frivolous spending. This safeguards your financial goals.

Adaptability: If your financial situation changes—say, you get a raise or reduce your expenses—you can easily adjust the automatic transfer amounts to better align with your new circumstances.

Peace of Mind: Knowing that your savings are growing without requiring active intervention frees mental space and reduces stress. This peace of mind can be invaluable, particularly when unexpected expenses arise.

Practical Tips for Setting Up Automated Savings:

Start Simple: If you're new to this, start by automating a small amount to your emergency fund each month. As you get comfortable, expand the automation to your other buckets.

Consult Your Budget: Use your budget as a guide for how much to automate. Your budget should have a line item for savings, just like it does for other expenses.

Check the Terms: Some savings accounts have terms and conditions related to deposits and withdrawals. Ensure you're aware of these to avoid any penalties.

Review and Tweak: At regular intervals—perhaps quarterly or bi-annually—review your automated savings strategy. Adjust the amounts and goals as necessary, especially when undergoing lifestyle or income changes.

Automation puts your savings on autopilot, allowing you to focus on other aspects of financial well-being without neglecting the cornerstone of financial security—your savings. Automate to Activate: The Easiest Way to Save

Wrapping Up: Your Financial Safety Net is More Reachable Than You Think

By now, you should have a clear roadmap to not just build but also sustain your financial safety net. We've talked about the necessity of an emergency fund and how it acts as your financial fire response system, ensuring you have the liquidity to deal with life's uncertainties. We've also dived into the 'savings buckets' strategy, encouraging you to categorize your savings based on your financial goals and time horizon. And finally, we've unveiled the power of automation, turning your savings strategy from a cumbersome task into a set-it-and-forget-it operation.

Coach's Comments:

Start with an Understanding: Assess your monthly expenses and multiply them by the number of months you'd like your emergency fund to cover.

Diversify Your Savings: Employ the 'savings buckets' strategy to categorize and prioritize your saving goals effectively.

Name Your Goals: Put meaningful names on your savings buckets to increase emotional investment and discourage unnecessary withdrawals.

Automate, Automate, Automate: Put your savings on autopilot to make consistent, timely contributions to your savings goals, all while giving you peace of mind and more mental space to focus on other aspects of your life -after a paycheck.

Saving might feel like a marathon, but it's one where the finish line can bring you incomparable peace of mind and financial freedom. So, start where you are, use what you have, and do what you can. Your future self will thank you.

Matt, The Compound Coach

Comments